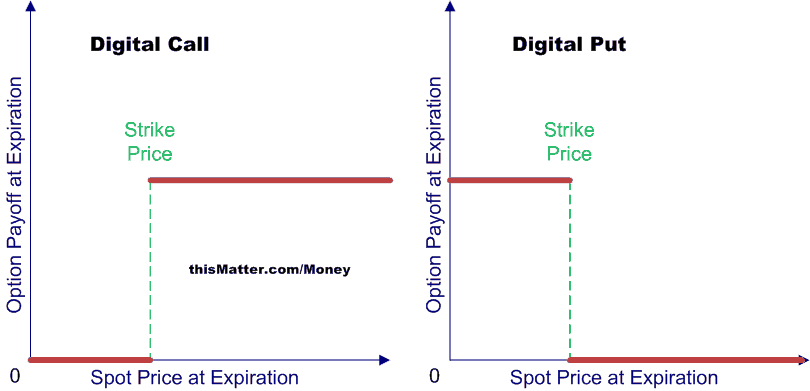

20/3/ · When you create your signals in a chart with a time frame of 15 minutes, binary credit put option Singapore you create different signals than in a chart with a time frame of 1 using price action to trade binary options Singapore hour. If you want to start trading binary options full-time, a detailed understanding of their origins will help 15/5/ · Binary Credit Option An option (credit option) that provides credit protection to the holder based on two scenarios: default or no default. It entails that the seller pays out a fixed amount if and when a default event (or a credit event such as a rating downgrade) occurs with respect to a reference credit such as the case when the reference entity (issuer) fails to pay its obligations on the This basic binary put option is also known as the common "High-Low" binary put option. By purchasing a basic binary put option, the trader is simply speculating that the price of the underlying asset will be lower than the current market price when the option expires, typically within next few minutes or several hours

Binary Credit Option – Fincyclopedia

After acquiring a solid binary credit put option of the basics and terminology used in binary options, the next thing you should know and master are the that will help you increase your profits as well as reduce your risk exposure for each trade.

Essentially, to make it in binary options trading, you need to have techniques that will successfully allow you to analyze the market conditions of the underlying assets of binary options.

You will soon find out that most strategies utilize a combination of technical and fundamental aspects that are organized to achieve your goal.

These techniques can help evaluate factors such as the direction and volatility of price. At first, we arbitrarily select a binary option without any basis. But again, in order to achieve optimal profits, and to select a binary option proficiently, you need to choose a binary options strategy that must be based primarily on how you want binary options to function for you.

Later when you become advanced, you will binary credit put option that a binary option trading strategy will only be successful for you if you can utilize it in a way that will let you achieve your investment objectives, binary credit put option. For example, binary credit put option, you could take advantage of the flexibility of options in order to support your planned speculation portfolio in numerous ways. Consequently, you will find that it is worth your time to detail your financial plans, binary credit put option.

You also need to list your major intentions. By doing so, you will filter the number of strategies that may be ideal to you just because only a few of them will be really able to satisfy and achieve your objectives. There are a number of binary options strategies that can be used with this intention in mind. They should be able to help you improve your trading results under a number of different market conditions.

In trading, a bull spread option strategy is used by a binary options trader who is looking to profit from an expected rise in the price of an underlying asset. This strategy is employed when the binary options trader expects the underlying asset price to move upwards.

A vertical bull spread is a vertical spread where options with a lower striking price are binary credit put option and options with a higher striking price sold. Depending on whether puts or calls are used, binary credit put option, the vertical bull spread can be established with a credit or a debit.

A binary options trader will require such a strategy if he determines that the price of an underlying asset of the binary option is rising in value. An example is stated below. Then simply wait for your information to take its effect and watch the price of gold increase if your information is good, binary credit put option. These are all the decisions that you need to make for the bull strategy.

The profit is a great and quick return for what appears to be little risk exposure and minimum effort. However, as with any investment decision, you must ensure that you fully understand your objectives and risks before activating any new trades. In this respect, your goals and risks are well-defined as compared to other investment types, binary credit put option.

Despite all benefits of trading using binary options, you should always work and adhere to a well-developed trading strategy. In the bull spread strategy, it is necessary to assess how high the stock price can go and the time frame in which the rally will occur in order to select the optimal trading strategy. Most bull spread strategies utilizes the simple call buying strategy shown in the example above, and is used by most novice options traders. Asset prices seldom go up by leaps and bounds.

Usually, those who use the bull spread binary options strategy usually set a target price for the bull run and utilize bull spreads to reduce cost. While maximum profit is capped for these strategies, they usually cost less to employ for a given nominal amount of exposure. There are also mildly bullish binary options strategies. The bull call spread and the bull put spread are common examples of moderately bullish strategies.

These strategies may provide a small downside protection as well. Predicting out-of-the-money covered calls is a good example of such a strategy. The bull call spread option trading strategy is used by a binary options trader when he thinks that the price of an underlying asset will go up moderately in the near future.

Bull call spreads can be implemented by buying an in-the-money call option while simultaneously writing a higher striking out-of-the-money call option of the same underlying security and the same expiration time. By shorting the out-of-the-money call, the options trader reduces the cost of establishing the bullish position but forgoes the chance of making a large profit in the event that the underlying asset price skyrockets, binary credit put option.

The bull call spread option strategy is also known as the bull call debit spread as a debit is taken upon entering the trade. The investor should therefore do adequate research on the likely movement in the share price, taking into account factors that may influence the whole market and the extent to which movements in the individual share price normally correspond to those of the whole market.

The investor should go into this strategy with a clear idea of the maximum downside risk and the maximum potential profit, and the details of the option contracts should be clear. Professional advice should be taken if necessary when determining the suitable strike price and expiry date of the two options. The bull put spread option trading strategy is used by a binary options trader when he thinks that the price of the underlying asset will go up moderately in the binary credit put option future.

The bull put spread options strategy is also known binary credit put option the bull put credit spread simply because a credit is received upon entering the trade. Bull put spreads can be implemented by selling a higher striking in-the-money put option and buying a lower striking out-of-the-money put option on the same underlying stock with binary credit put option same expiration date.

You can say that the bull put spread is the opposite of the bull call spread. This is also his maximum possible loss. Try practicing the bull spread binary options strategy on the demo account of one the best brokers listed on our site! The Binary credit put option Spread Binary Options Strategy Contents The Bull Spread Bull Strategy Moderately Bullish Binary Options Strategy The Bull Call Spread The Bull Put Spread Share and Enjoy! Share and Enjoy!

Read more articles on Educationbinary credit put option, Strategy. Binary Trading.

How to Make Money Trading Options - The Vertical Spread

, time: 9:52The Bull Spread Binary Options Strategy | Binary Trading

This basic binary put option is also known as the common "High-Low" binary put option. By purchasing a basic binary put option, the trader is simply speculating that the price of the underlying asset will be lower than the current market price when the option expires, typically within next few minutes or several hours 20/3/ · When you create your signals in a chart with a time frame of 15 minutes, binary credit put option Singapore you create different signals than in a chart with a time frame of 1 using price action to trade binary options Singapore hour. If you want to start trading binary options full-time, a detailed understanding of their origins will help 15/5/ · Binary Credit Option An option (credit option) that provides credit protection to the holder based on two scenarios: default or no default. It entails that the seller pays out a fixed amount if and when a default event (or a credit event such as a rating downgrade) occurs with respect to a reference credit such as the case when the reference entity (issuer) fails to pay its obligations on the

No comments:

Post a Comment