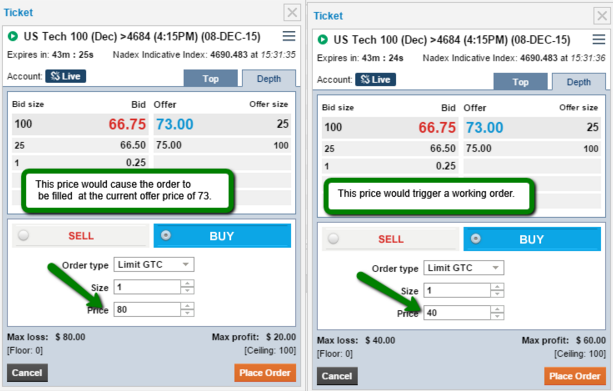

A very popular hedging method in binary options trading is “the straddle”. This strategy is not easy because it’s difficult to find the righ setups. It’s a strategy about two contracts with different strike price to the same asset. Let’s see a screen shot. This binary option chart is from GBPUSD currency pair/5() Say for example that you choose “High” on a binary option for a particular currency pair, but you want to hedge and open a smaller bearish position. If you are also a Forex trader, you could open a smaller bearish position on your Forex platform at the same time you enter into your bullish binary options trade 19/3/ · Number of binary put options required = total hedge required/maximum profit per contract = $1,/$75 = Total cost for hedging = $ * 20 * = $

Hedging in Binary Options Trading - How to Implement Hedges for Binary

In this article I am going to discuss and explain you some hedging methods that you can try with Binary Options contracts. First of all, I want to explain what is exactly hedging.

Hedging is a way to reduce the risk of your trades. This binary option chart is from GBPUSD currency pair. The general idea of this strategy is to create bounds for the same asset with two contracts. To create an ideal straddle you must find the higher level of a trading period and take a call and the lowest level of a trading period and take a put. A good trading period for straddle is when the price is moving inside a symmetric channel like this.

There is not much volatility to create unpredictable situations. So, look at the chart. We have a previous resistance and a previous support. When the price hit the resistance which the highest level for now we can take a put with 15 minutes expiry for example.

After that the price is moving down and hit the previous support which is the lowest level for now. In this level how to hedge with binary options can take a call with the same expiry, 15 minutes.

Five minutes ago we took a put in the support which expires in the money,too. So, in the first scenario we have 2 ITM trades with a high reward. So, we have an ITM put and an OTM call. This means a very small loss for us, how to hedge with binary options.

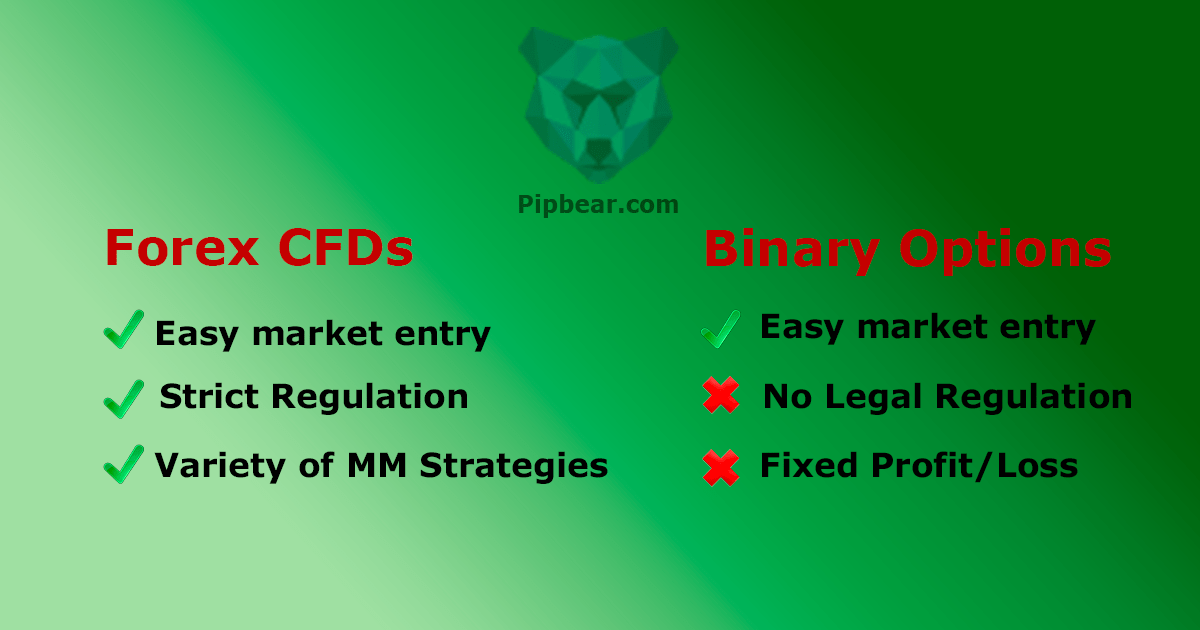

So, if a trader will create a good straddle the possible scenarios are a high reward or a very small loss. These strategies are mainly for binary options trading in an exchange and are about hedging the same or different assets, how to hedge with binary options. GBPUSD and USDCHF are two currency pairs which usually moving opposite to one another.

This is from GBPUSD currency pair. You can see that at the GBPUSD is moving up and about 50 minutes is still moving up. Now, this USDCHF currency pair chart and you can see that the same time the price is moving down and about 50 minutes is still moving down.

So, there are opportunities to trade this. I usually open 2 trades one in GBPUSD and another one how to hedge with binary options USDCHF in Spread Betting or Spot Forex with the same direction.

You will win one of them for sure. For being profitable with this you should find the right time in which these two currency pairs give you a profit. For example in this chart we can open two sell orders.

Even in first 10 minutes we will have profit because the downtrend in USDCHF is stronger than the uptrend in the beginning. For doing this in Spot or in Spread Bets you must have a good margin in your account.

These two pairs EURUSD and GBPUSD are moving in the same direction. You can hedge them in a binary options exchange. For the example we will use 2 five minutes contacts in these 2 currency pairs.

The contracts are opening for example at and the expiry is at We how to hedge with binary options buiyng a call contract for the one of them and a put contract for the other. After some minutes the market has moved to one direction up or down. One of our contracts will ITM and the other OTM. You must be logged in to post a comment.

Free Binary Options Charts Live Binary Charts For Free. Home Free MetaTrader Brokers Strategy Dont Trust Signals Forex Trading Vs Binary Trading Who Am I? Home » Strategy how to hedge with binary options Binary Options Trading Hedging Methods. Binary Options Trading Hedging Methods In this article I am going to discuss and explain you some hedging methods that you can try with Binary Options contracts.

Some more binary options hedging strategies These strategies are mainly for binary options trading in an exchange and are about hedging the same or different assets, how to hedge with binary options. Hedging GBPUSD and USDCHF GBPUSD and USDCHF are two currency pairs which usually moving opposite to one another. Hedging EURUSD and GBPUSD These two pairs EURUSD and GBPUSD are moving in the same direction.

VN:F [1. please wait Leave a Reply Click here to cancel reply. Binary Options Broker Of The Week. Read Review Open Account. All Rights Reserved. Free Binary Options Charts.

How to hedge in binary options - How to predict next candlestick - IQ Option

, time: 13:25Hedging with Binary Options | Juliana's Guide

:max_bytes(150000):strip_icc()/HowtoHedgeStockPositionsUsingBinaryOptions4-a71beb3628744845b179de7ad6180449.png)

19/3/ · Number of binary put options required = total hedge required/maximum profit per contract = $1,/$75 = Total cost for hedging = $ * 20 * = $ 3/5/ · There are numerous additional binary options that can be used to create a hedge portfolio. A hit or miss option can be use to specifically protect both long and short positions. A miss option can even act like a covered call. Again when looking at the long EUR/USD position, a trader could purchase a miss option above the market Binary Options Hedging Strategy with a High Success Rate

No comments:

Post a Comment